- #Accounts payable turnover ratio ugba 102a how to

- #Accounts payable turnover ratio ugba 102a software

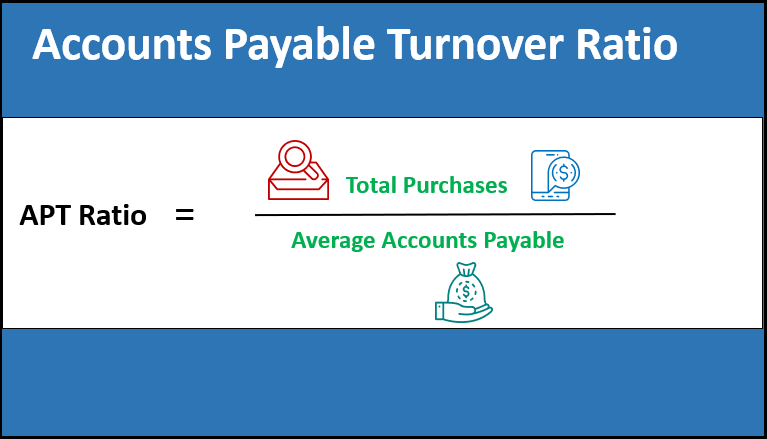

That means 1.8 is your accounts payable turnover ratio. Let’s say your company’s total net credit purchases for the year were $200,000, and your average accounts payable for the year were $110,000. Here’s a quick example of calculating AP turnover ratio: Simply add the beginning and ending accounts payable balances for the period and divide them by two. You can calculate the average accounts payable for the specific period by referencing your financial statement. If not, purchases can be calculated by subtracting the starting inventory from the ending inventory and adding that to the cost of sales. If your company uses accounts payable software, the total credit purchases are something that can be automatically generated. Total net credit purchases from all suppliers during the period ÷ Average accounts payable for the period That being said, here is a basic formula for AP turnover ratio: It shows how well a company can pay off its accounts payable by comparing net credit purchases to the average accounts payable. Get your calculators ready because it’s time for a quick math lesson.Īs previously mentioned, accounts payable turnover ratio is a liquidity ratio.

#Accounts payable turnover ratio ugba 102a how to

How to calculate accounts payable turnover

#Accounts payable turnover ratio ugba 102a software

However, more and more companies are investing in software and resources in order to optimize the accounts payable function, which in turn improves AP turnover ratio. Traditionally, accounts payable has not been regarded as a valuable, expansive part of a business, so something like AP turnover ratio is not regularly calculated, let alone even on a company’s radar. The higher the accounts payable turnover ratio, the quicker the business pays off its debt. The KPI only measures your company’s accounts payable, which represents the money you owe to vendors and appears on your company’s balance sheet as a current liability (a short-term debt)ĪP turnover ratio is an indicator of a business’ short-term liquidity (i.e., cash flow), meaning it’s a calculation of the company’s ability to pay its short-term debts. Definition of accounts payable turnover ratioĪP turnover ratio is a type of financial ratio that essentially gauge how often a company pays its suppliers by considering the total cost of goods sold over a certain period, usually a month or a year.

And to achieve this, AP must ensure that invoices are paid in a timely and accurate fashion.Īn accounting metric that is often ignored but can provide a vital glimpse into how your company measures up financially is the accounts payable (AP) turnover ratio. In an economic environment where suppliers are in power to decide whom they want to do business with, it is critical to maintain a strong supplier relationship. We all strive to have healthy relationships, and for a company, how good or bad a relationship is with its suppliers is dependent on how financially healthy the business is. How to Improve Your AP Turnover Ratio and Strengthen Your Relationship with Suppliers

0 kommentar(er)

0 kommentar(er)